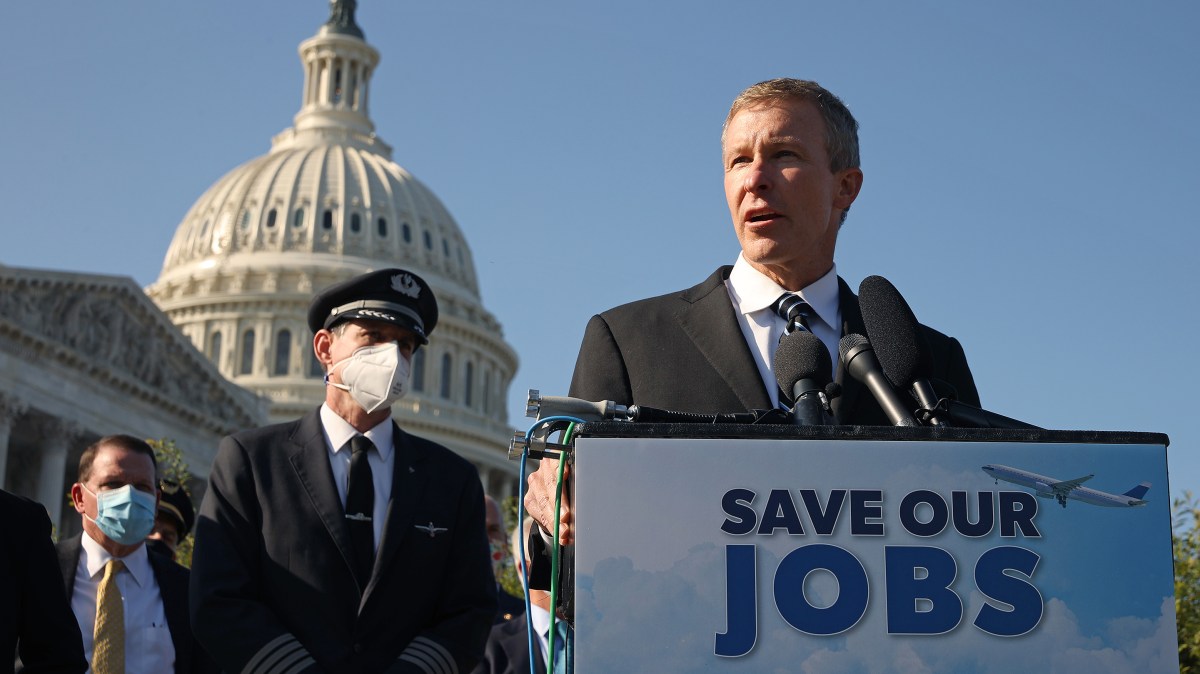

Airlines ask for bailout extension

Airline CEOs and union leaders this week beseeched Congress for an extension of the Payroll Support Program — part of the CARES Act that amounted to a $25 billion industry bailout.

The funding was supposed to help airlines maintain their payrolls until travel demand returned, but that’s not happening fast enough.

Now the industry is warning of a massive wave of layoffs if lawmakers don’t extend funding before Oct. 1.

According to the trade group Airlines for America, passenger volume is off about 65% from a year ago. And airlines are collectively burning through $5 billion each month.

CEO Nick Calio said airlines are asking for a six-month extension “because hopefully by then we will be over the hump. And we will start to have a pickup in travel by next spring.”

The conditions of the previous bailout protected workers until Oct. 1.

Calio warned that up to 100,000 airline employees could soon join the ranks of the unemployed.

And Robert W. Mann, a former airline executive and industry consultant, said a second bailout would help the U.S. economy recover faster when the pandemic wanes.

“If the industry were to fall into disrepair, if it were to fall into destructive restructuring during the pandemic, the question would be, what would you have around to help you around on the other side?” Mann said.

When, exactly, we get to the other side of the pandemic is still murky.

Veronique de Rugy, senior research fellow at George Mason University’s Mercatus Center, said another $25 billion is not going to solve the problem.

“This is just postponing the inevitable,” she said. “As long as the demand doesn’t go back up, this is just basically a Band-Aid patch.”

She said bankruptcy would be the best option. Airlines have shown they can emerge from restructuring healthier. And she said that means troubled airlines don’t pose a major risk to the economy at large.

Stories You Might Like

What does the unemployment picture look like?

It depends on where you live. The national unemployment rate has fallen from nearly 15% in April down to 8.4% percent last month. That number, however, masks some big differences in how states are recovering from the huge job losses resulting from the pandemic. Nevada, Hawaii, California and New York have unemployment rates ranging from 11% to more than 13%. Unemployment rates in Idaho, Nebraska, South Dakota and Vermont have now fallen below 5%.

Will it work to fine people who refuse to wear a mask?

Travelers in the New York City transit system are subject to $50 fines for not wearing masks. It’s one of many jurisdictions imposing financial penalties: It’s $220 in Singapore, $130 in the United Kingdom and a whopping $400 in Glendale, California. And losses loom larger than gains, behavioral scientists say. So that principle suggests that for policymakers trying to nudge people’s public behavior, it may be better to take away than to give.

How are restaurants recovering?

Nearly 100,000 restaurants are closed either permanently or for the long term — nearly 1 in 6, according to a new survey by the National Restaurant Association. Almost 4.5 million jobs still haven’t come back. Some restaurants have been able to get by on innovation, focusing on delivery, selling meal or cocktail kits, dining outside — though that option that will disappear in northern states as temperatures fall. But however you slice it, one analyst said, the United States will end the year with fewer restaurants than it began with. And it’s the larger chains that are more likely to survive.

As a nonprofit news organization, our future depends on listeners like you who believe in the power of public service journalism.

Your investment in Marketplace helps us remain paywall-free and ensures everyone has access to trustworthy, unbiased news and information, regardless of their ability to pay.

Donate today — in any amount — to become a Marketplace Investor. Now more than ever, your commitment makes a difference.

tinyurlis.gdv.gdv.htu.nuclck.ruulvis.netshrtco.detny.im