Fairway Independent Mortgage Review for 2020

Overview

Fairway Independent Mortgage is headquartered in Madison, WI, and was founded in 1996. Since then, it's become one of the top mortgage lenders in the nation.

Fairway is licensed to lend mortgages in all 50 states and Washington DC. And it's known for having exceptional customer service. This company came second overall in J.D. Power's 2019 Mortgage Customer Satisfaction Study, and has a top A+ rating from the Better Business Bureau. Fairway has also invested heavily in technology, allowing customers to apply for a mortgage and track loan progress online or via app. As for mortgage rates and fees, Fairway seems to be competitive rather than industry-leading. But rates vary by customer, so you'll have to get a quote to see if Fairway's rates are best for you.Fairway Mortgage rates

Our table shows average rates and loan costs from 2019.

Your own rate will likely be lower, because mortgage rates have dropped significantly since then.

But what our table does help you see is how Fairway mortgage rates and fees generally compare to other top lenders.

Average 30-year mortgage rates at major lenders

Fairway Independent Mortgage |

Wells Fargo |

Quicken Loans |

Chase |

|

Average 30-Year Interest Rate, 2019 |

4.33% | 4.22% | 4.16% | 4.22% |

Monthly P&I Payment* |

$993 | $980 | $973 | $980 |

Median Loan Costs, 2019 |

$3,954 | $3,484 | $5,075 | $3,440 |

Median Origination Charge, 2019 |

$1,195 | $1,199 | $2,085 | $1,279 |

It’s worth noting that Fairway helps more people with lower credit scores than many other lenders. And that can skew its rates higher on average.

So if you like what Fairway has to offer, it’s worth applying to see how low of a rate this company can offer you.

Average rate and fee data were sourced from public rate and fee records required by the Home Mortgage Disclosure Act (HMDA).

*Monthly principal and interest payment based on a $250,000 home price, with 20% down, at each company’s average 30-year interest rate for 2019. Your own rate and monthly payment will vary.

Verify your new rate (Sep 16th, 2020)Fairway Mortgage review for 2020

Fairway Mortgage must be doing plenty right. Because its customer satisfaction scores place it near the very top of the industry, and the growth of its business has been impressive.

So what’s the secret to Fairway’s success? Well, it likely breaks down into three parts:

- The breadth of its loan portfolio means it can find the right mortgage for nearly all applicants — From those wanting multimillion-dollar loans to those with low savings and damaged credit

- Fairway offers highly personalized service over the phone or in its branches — But it also allows you to use its online, self-service technologies (including an app) as much as you like

- It seems to place genuine emphasis on customer satisfaction — Unlike those lenders that only talk the talk

The main drawback from our perspective is that you have to apply to see rates; they’re not advertised online.

But advertised rates are only a sample, and you have to apply to see your actual rate at some point anyway. So that’s not a huge drawback.

Working with Fairway Independent Mortgage

Fairway has over 500 branches, with at least one in 48 states plus Washington DC.

This means you have a better chance of meeting a loan officer in person than with many other lenders, who might have fewer branches in fewer states.

However, Fairway does not require you to meet with a loan officer in person.

Fairway says that you can complete an online application in as little as 10 minutes.

Many applicants simply talk to a loan officer over the phone, or apply online through the lender’s website or mobile app.

Fairway says that you can complete an online application in as little as 10 minutes.

The Fairway Mortgage website also lets you securely upload loan documents and check on your loan progress. So you never have to wonder what stage your application is at.

Fairway can help lower-credit borrowers buy a home

Suppose your mortgage application fails because your credit score is too low. The company’s website says:

“If your Loan Officer determines that you can benefit from credit score improvement, you may be referred to work with Fairway’s internal Creditool team at which time you’ll be asked to take part in our program.

“One of our highly skilled credit analysts will be assigned to review your credit report and draft a credit improvement action plan for you. There is no cost to you to do so.”

Credit score is one of the most important factors when applying for a mortgage, so one-on-one counseling to help improve your score is a big benefit.

Fairway Mortgage customer service reviews

We’ve already praised Fairway’s customer service. But here are some details.

Mortgage-related complaints at major lenders

Company |

Mortgage Originations 2019 |

CFPB Complaints 2019 |

Complaints Per 1,000 Mortgages |

2019 JD Power Rating |

Fairway Independent Mortgage |

198,516 | 16 | 0.08 | 865/1,000 |

Wells Fargo |

1,026,800 | 342 | 0.33 | 837/1,000 |

Quicken Loans |

774,900 | 187 | 0.24 | 880/1,000 |

Chase |

527,600 | 188 | 0.36 | 850/1,000 |

Fairway Independent Mortgage ranked second in the J.D. Power’s 2019 mortgage satisfaction study, coming in just behind Quicken Loans (the 10-year winner).

In addition, less than one customer per thousand complains about Fairway to the Consumer Financial Protection Bureau (which keeps a record of official mortgage complaints).

Fairway also scores highly on consumer forums. It gets 5 stars on SocialSurvey and Zillow, and four or five stars on various Yelp review pages.

Overall, these make it a top company for service out of the major mortgage lenders.

Mortgage loan products at Fairway

Fairway has an extensive list of mortgage options:

- Fixed-rate mortgages — The most popular type of mortgage with an interest rate and payment that are fixed for the full loan term

- Adjustable-rate mortgages — These start with a fixed rate for a few years, then your rate can move up or down annually

- Conventional mortgages — Loans from private lenders or backed by Fannie Mae or Freddie Mac. These start at 3% down payment

- Jumbo mortgages — Loans above the conventional limit, which is $510,400 in most parts of the U.S.

- FHA mortgages — Good for those with lower credit. As little as 3.5% down payment

- VA mortgages — Eligible veterans and service members can get great rates and a 0% down payment

- USDA rural development mortgages — Zero down payment if you’re buying in an eligible rural area and have a qualifying income

- Refinance programs — Get cash out or secure a lower mortgage rate and monthly payment

- Physician Loan Program — Medics can put down as little as 5% with no mortgage insurance required

- Reverse mortgages — For those 62 years or older who want to release some of their home’s equity to enhance their retirement. No monthly payments

- Home renovation loans — It’s all in the name

- Residential construction loans — For when you want to build your home instead of buying one

- Residential lot loans — Used to buy a plot of land to build a home on

- Investment property mortgages — Buy a home that you’ll rent out to others

- Debt consolidation mortgages — AKA cash-out refinances

Chances are, one of those will suit you. Its just a matter of finding the right loan type based on your credit, down payment, location, and financing goals.

Verify your new rate (Sep 16th, 2020)Where can I get a mortgage with Fairway?

You can get a loan from Fairway mortgage anywhere in the US. It’s licensed to lend in all 50 states.

And there’s likely a branch near you, because there’s one or more in 48 states and Washington DC.

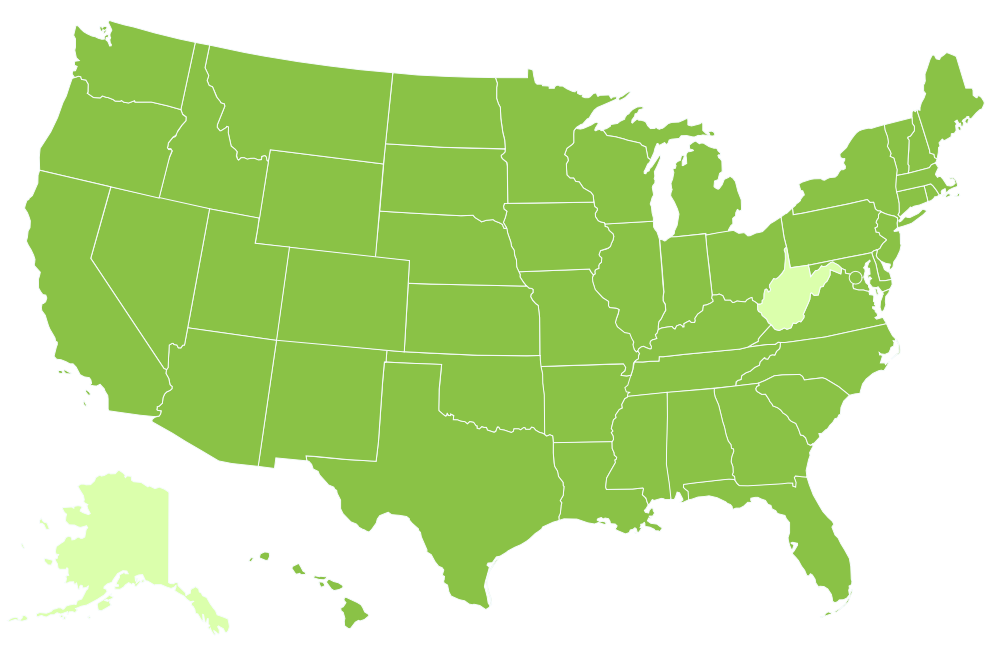

Fairway has branch locations in 48 states (shown in dark green above). Only Alaska and West Virginia (light green) are without branches.

The two states where Fairway doesn’t have a physical presence are Alaska and West Virginia. With the latter, you may be able to access a branch by popping across the border into a neighboring state.

But things aren’t that easy for Alaskans. So they’ll have to rely on the phone and mail or the internet — or any combination thereof.

Is Fairway Independent Mortgage the best lender for you?

Fairway Mortgage may turn out to be the best lender for you.

Fairway has a wide enough range of home loans to suit most people, and its customer service earns top ratings.

We’d especially recommend looking at this company if your credit score is too low, or on the borderline, for mortgage qualifying. In that case, the company’s free credit counseling could be a huge help.

To decide whether Fairway Independent Mortgage is best for you, check rates and terms from a few different lenders and weigh your options carefully.

Verify your new rate (Sep 16th, 2020)tinyurlis.gdv.gdv.htu.nuclck.ruulvis.netshrtco.detny.im