Guild Mortgage Review for 2020

Overview

Guild Mortgage has been in business since 1960, making it one of the oldest independent mortgage companies in America.

And the company only seems to be growing in popularity. In fact, Guild Mortgage says it's grown 16-fold since 2007. Likely, that has to do with the company's top-rated service — it came third in J.D. Power's 2019 mortgage lender satisfaction study. Guild also has an especially wide range of loan types, so the majority of borrowers should be able to find the kind of mortgage they need. Of course, mortgage rates vary by customer. So Guild may or may not give you the best offer. You'll have to compare loan estimates from a few mortgage lenders to find out.Guild Mortgage rates

The table below compares averages mortgage rates and fees for 2019. Mortgage rates have fallen a long way since then, so these likely are not close to the rate you’ll get.

But, the table can help you see how competitive Guild Mortgage rates are next to other major lenders.

Average 30-year mortgage rates at major lenders

Guild Mortgage |

Wells Fargo |

Quicken Loans |

Chase |

|

Average 30-Year Interest Rate, 2019 |

4.15% | 4.22% | 4.16% | 4.22% |

Monthly P&I Payment* |

$972 | $980 | $973 | $980 |

Median Loan Costs, 2019 |

$5,165 | $3,484 | $5,075 | $3,440 |

Median Origination Charge, 2019 |

$1,679 | $1,199 | $2,085 | $1,279 |

Guild seemed to have a slightly lower rate on average than these other companies. But its loan origination fees were a bit higher.

Of course, offers vary by customer. So your rates and fees grom Guild could be higher or lower than average. To find out, you’ll need to request a custom loan estimate.

Average rate and fee data were sourced from public rate and fee records required by the Home Mortgage Disclosure Act (HMDA).

*Monthly principal and interest payment based on a $250,000 home price, with 20% down, at each company’s average 30-year interest rate for 2019. Your own rate and monthly payment will vary.

Verify your new rate (Sep 16th, 2020)Guild Mortgage review for 2020

Guild’s success seems to be built on customer satisfaction and loyalty.

It scores very highly there, coming third in the J.D. Power 2019 U.S. Primary Mortgage Origination Satisfaction Study. It was just a single point (out of 1,000) short of sharing second place.

It’s hard not to like a company that inspires such loyalty in its customers.

And it helps that Guild seems to go out of its way to help applicants who might be turned down by other lenders.

Help for first time home buyers

Guild Mortgage cooperates with 500 down payment assistance (DPA) programs.

These are special grants and loans that offer extra money towards your down payment and/or closing costs, often allowing those with lower savings to achieve homeownership.

DPA programs are often geared toward first time home buyers. But you don’t always need to be a first-timer to access them.

Some are available to repeat homebuyers who haven’t owned a home in the past three years, as well.

Guild Mortgage credit score requirements

Guild’s credit score thresholds are pretty typical for major lenders. It requires:

- 580 for VA loans — Backed by the Department of Veterans Affairs and available almost exclusively to veterans and those still serving in the military

- 600 for FHA and USDA loans — Backed by the Federal Housing Administration or the US Department of Agriculture

- 620 for some other types of mortgages — Though your score will need to be higher if you want a jumbo loan or an ultra-low rate

Guild Mortgage may also take into account “alternative” credit information — like on-time payments for rent, utility bills, and other expenses that don’t typically make it onto credit reports.

That means it might be able to help people who make payments responsibly, but haven’t borrowed enough in the past to build up a robust credit score on the FICO scale.

Guild mortgage rates and transparency

Guild Mortgage doesn’t advertise current rates on its website.

That means you can’t skim to see how it compares with other lenders’ advertised rates. You’ll have to actually apply and get a quote to see what you can get.

However, you don’t have to worry about a hard credit pull if you want to check rates with Guild.

The company says, “Early quotes prior to credit pulls are based upon the borrower’s own educated estimate of their credit rating. If they don’t know, then standard practice is to utilize a midrange credit score that has no impact to the pricing of the quote.”

So in the first round — before you officially apply for a loan — you can get a rate estimate without your credit score being dinged.

Working with Guild Mortgage

Guild is not licensed to lend in New Jersey or New York. But customers in the other 48 states are welcome to apply.

Guild offers the full spectrum of customer service options, from in-person service to a fully online experience. As a customer, you can choose what suits you best.

When you start out on the company’s website, you have two options. You can find a loan officer near you or begin an online application.

If you choose the online option, you’re able to:

- Save your part-completed application and come back to it later

- Securely upload loan documents

- Track your application’s progress

- E-sign your closing documents remotely, using what Guild calls its eClose option (availability depending on your state’s law)

You might even be able to get your mortgage without once interacting with a human being.

If you quite like interacting with human beings, you’ll start with an initial phone conversation with a loan officer; there’s a lookup tool on the lender’s website to help you find one.

If one’s close enough to your home, you can (in normal) times set up a face-to-face meeting.

There’s a good chance you’ll prefer a blend of those two. Maybe you want to chat with a loan officer and make your application online. Or complete an application in a branch and then upload your documents. You get to choose.

Homebuyer Express (“HBE”) — 17 Day Closing Guarantee

Guild Mortgage is so confident in the efficiency of its people and systems that it offers applicants confidence that the loan will be closed in a timely manner.

Providing your home has been under contract for at least 17 days prior to the scheduled closing, you stand to be reimbursed $500 in closing costs if Guild holds you up. But check the lender’s website for terms and conditions.

Guild Mortgage customer service reviews

You’ll already have gathered that Guild’s great strength is its customer service.

Mortgage-related complaints at major lenders

Company |

Mortgage Originations 2019 |

CFPB Complaints 2019 |

Complaints Per 1,000 Mortgages |

2019 JD Power Rating |

Guild Mortgage |

119,400 | 13 | 0.11 | 846/1,000 |

Wells Fargo |

1,026,800 | 342 | 0.33 | 837/1,000 |

Quicken Loans |

774,900 | 187 | 0.24 | 880/1,000 |

Chase |

527,600 | 188 | 0.36 | 850/1,000 |

Along with a strong J.D. Power survey score, it has an A+ rating from the BBB and has very few customer complaints registered with federal regulator The Consumer Financial Protection Bureau.

Guild also took second place in our review of the best mortgage lenders for 2020.

Mortgage loan products at Guild

Guild has a broad range of fixed-rate and adjustable-rate mortgages. These include:

- Conventional loans — Great when you have a higher credit score (above 620). Conventional loans allow as little as 3% down payment

- “Jumbo” loans — Outsized mortgages for those buying very expensive homes

- FHA loans — For when your credit score’s too low for a conventional loan. You can put as little as 3.5% down

- USDA loans — Allow 0% down for low- to moderate-income borrowers in eligible rural and suburban areas

- VA loans — Eligible veterans and service members can get a VA loan with 0% down and exceptionally low rates

- Renovation loans — For when you want to make upgrades to your home

- Reverse mortgages — When you’re 62 years or older and want to access some of your home equity to enhance your retirement. Zero monthly payments

- MH Advantage — A loan that allows you to buy a manufactured home

That large portfolio means there’s a high chance of Guild being able to assist you.

Where can I get a mortgage with Guild?

You can apply for a Guild mortgage everywhere in the US except New Jersey and New York.

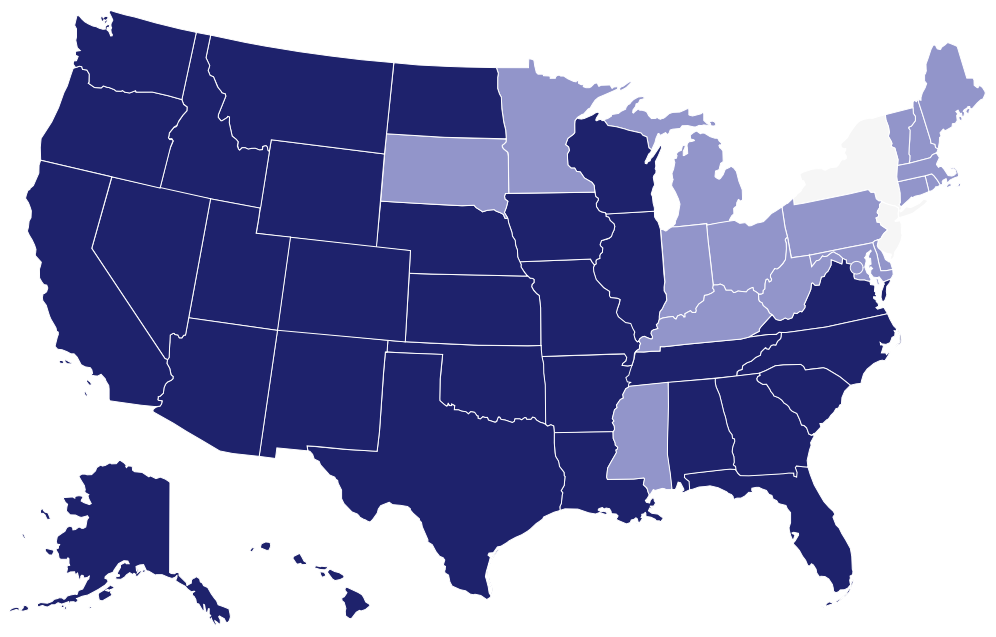

Guild mortgage has branches in 31 states (dark blue). In states without branches (light blue) Guild is available online or over the phone.

Guild has 250+ branches and offices in 31 states across America.

That sounds a lot, but with such a large landmass, many borrowers will find the locations are too far from home for in-person visits.

If your home is a long way from your nearest branch or satellite office, you can use the phone or internet to conduct business.

Is Guild Mortgage the best lender for you?

The only real drawback we found about Guild Mortgage is that you have to apply to get an idea of its rates — so you can’t compare it to other lenders at a glance.

However, applying is the best way to see your real rate anyway.

Advertised rates assume excellent credit and a big down payment, so they’re misleading for many borrowers.

Guild doesn’t do a hard credit pull right away, so checking rates won’t hurt your score.

But remember to compare personalized rates from a few other lenders, too. That’s the only way to truly know which is the best mortgage lender for you.

Verify your new rate (Sep 16th, 2020)tinyurlis.gdv.gdv.htu.nuclck.ruulvis.netshrtco.detny.im